Essentials: Multiple selling locations tutorial

Description

What's in this article?

This tutorial walks you through a real-world example of how the system can be used in truly mobile scenarios. In our example, we have a small cafe in downtown Atlanta, which puts us in Fulton County. The name of our company is Savory Foods.

Follow along to learn how to set up a tax category for food using the Fulton County, Georgia, current tax rate.

- Step One: Set Up a Primary Tax Category

- Step Two: Set Up Selling Locations

- Step Three: Add Additional Tax Categories

Step one: Set up a primary tax category

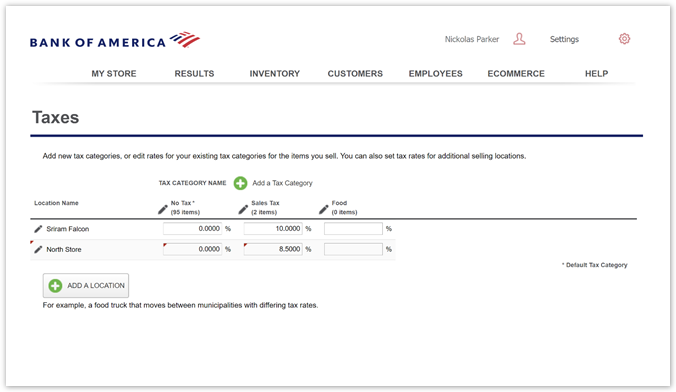

When we first see the Taxes screen, it looks like this. Notice that our company name is listed as our Location Name. This was done when we initially registered our account. It is our default or "home" location. We won't be able to edit or delete this location name. You may also notice that we already have the default tax category of No Tax set up for us.

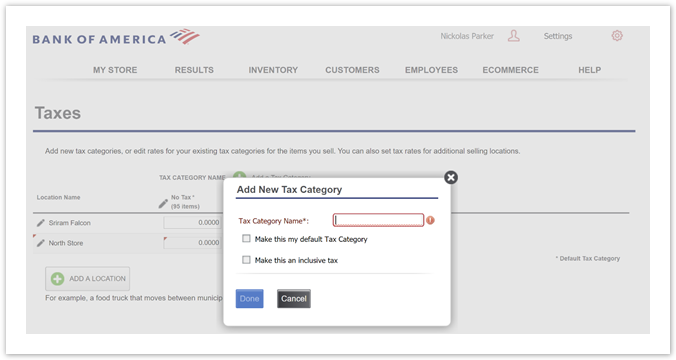

We are a café, so we need to set up a tax category for Food and then enter the tax rate for Fulton County GA. To do this, we click ADD A TAX CATEGORY and set up a tax category named Food and make it our default tax category, since we sell food items, and click Done.

Then, we click in the box below our new Food tax category and enter the food tax of 5.25% for Fulton County, GA and click the Save button. When we're done, our Taxes screen looks like this. If you see any small, red triangles, they show you where information on the screen has changed since the last save.

That's it! Our taxes are all set up, and we are ready to start entering our items in our inventory. Remember, we made Food our default tax category, so all the items we create will be automatically assigned to the Food tax category. However, if we have some items that are not taxed, we can simply click the Tax Category drop-down for that item and change the tax category from Food to No Tax.

Step two: Set up selling locations

In step one, we created our Food tax category, and our Savory Foods cafe is doing well. Actually, we are so popular, we decide to branch out and sell through a food truck. Being mobile will allow us to sell our food throughout metropolitan Atlanta. Unfortunately, each county in our Atlanta selling area charges different tax rates for food. No problem, the system can handle this for us to ensure we are charging the correct sales tax no matter where we are selling our items.

- Add Our Selling Locations

Next, it's time to enter the other locations where our food truck travels – Cobb County, Dekalb County and Forsyth County. We click ADD A LOCATION, enter Cobb County and click the Done button. We repeat this same process for Dekalb County and Forsyth County. Now that we have added our additional selling locations, we need to enter the tax rate for food for each of our selling locations. We also need to go ahead and enter a tax rate of 0.00 for the No Tax category. Simply click inside the box for each selling location and tax category and enter the tax rates. When we are done, we click the Save button.

When we've added each of the counties where our food truck sells, our Taxes screen looks like this:

- Time to Sell

OK, our setup is done, and we are ready to head to Forsyth County to have a great day of sales. When we get there, we log in to the POS app, and because we've already set up additional selling locations, the system asks us "Where are you selling today?" We select Forsyth County from the list, and that's it. Now, every sale will charge the Forsyth County food tax rate. If there aren't enough customers, or there are too many competitors, we can pack up and drive to Cobb County. When we get there and log in to the POS app, we select Cobb County as our selling location, and we're done. The system will track all of our sales and display our selling locations on the Taxes Report.

Step three: Add additional tax categories

So, now the Savory Foods Cafe and our Savory Foods On the Move food truck are experiencing incredible sales, and we have become very popular and have quite a fan base. Our food truck often travels to festivals and concerts, and our customers have asked us to sell beer along with our great good. Some of our customers have even asked for t-shirts and caps with our Savory Foods logo on them. Life is good! These additions to our items are not classified as food, so we will need to add two new tax categories, Alcohol and General Merchandise. Just like Food, each of our selling locations charge different tax rates for these as well. No problem, the system can handle that too.

We'll start with adding the additional tax categories first, and then we will enter the tax rates for each selling location.

Click ADD A TAX CATEGORY and set up a tax category named Alcohol and click the Done button. Now, repeat this same process to add the General Merchandise tax category.

Now that we have added the new tax categories, we will need to enter the tax rate for each of our selling locations for the two new tax categories. Click in the box below our new Alcohol tax category and enter the alcohol tax for each selling location, including our default/home location in Fulton County. Then, click in the box below our other new General Merchandise tax category and enter the general merchandise tax for each selling location and click the Save button. When we're done, our Taxes screen looks like this:

We're almost done. We've got our selling locations, tax categories and tax rates for each selling location. Now, we need to add our new items to our inventory. Remember, we made Food our default tax category, so all the items we create will be automatically assigned to the Food tax category. Since alcohol is taxed differently than food items, when we add the new beer that we sell, we will click the Tax Category drop-down for that item and change the tax category from Food to Alcohol. When we add our new Savory Foods t-shirts and caps, we will click the Tax Category drop-down for that item and change the tax category from Food to General Merchandise.

- Time to Sell

OK, our setup is done, and we are ready to sell all of our new items in each of our selling locations. As before, whenever we arrive to our selling location and log in to the POS app, we select our selling location from the list, and that's it. Now, every sale will charge the correct tax rates for all of our items. The system will track all of our sales and display our selling locations on the Taxes Report.